📈 Japan’s job market #2: Wage hike – a break from stagnation?

💰 After years of wage stagnation, Japan’s labor market is shifting with over 90% of companies increasing base salaries in 2024. Major firms lead the way, but SMEs are also seeing spillover effects. More importantly, fresh graduates are benefiting from this significant salary boosts!

*******

🔍 Wages and Deflation

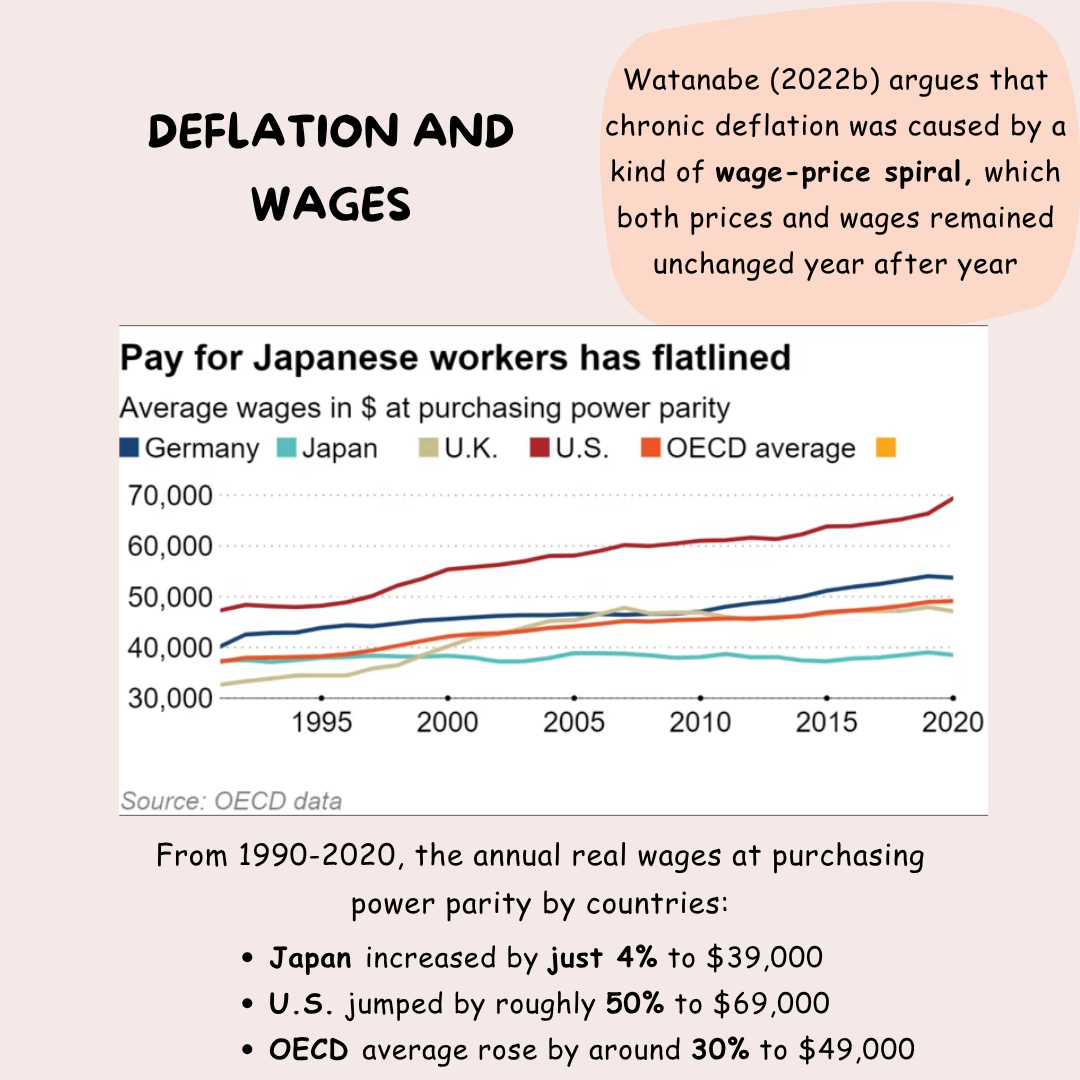

Watanabe (2025) provides an important lens for understanding Japan’s economic stagnation. He argues that a form of wage-price spiral contributed to chronic deflation—a cycle in which both wages and prices remained static year after year, reinforcing economic malaise.

Between 1990 and 2020, the stagnation was clearly visible in international comparisons. Japan’s annual real wages, measured at purchasing power parity, increased by only 4%, reaching about $39,000. In contrast, the United States saw a 50% jump to approximately $69,000, while the OECD average climbed by about 30% to nearly $49,000.

🛠️ Why Did Wages Stall?

The roots of this wage stagnation go back to the early 1990s, when the bursting of the asset price bubble led many companies to abandon base salary increases altogether. This mindset crystallized in 2002 with the so-called “Toyota Shock,” when Toyota became one of the first companies to adopt a zero base wage increase policy in an effort to stay globally competitive. This move had a ripple effect across Japan Inc., as other companies followed Toyota’s path.

Compounding the issue, the Japanese Trade Union Confederation (JTUC-RENGO) did not issue a unified demand for base wage increases from 2003 through the early 2010s. The lack of coordinated labor pressure allowed the wage freeze to persist nearly unchecked.

🌅 Post-Pandemic Wage Recovery

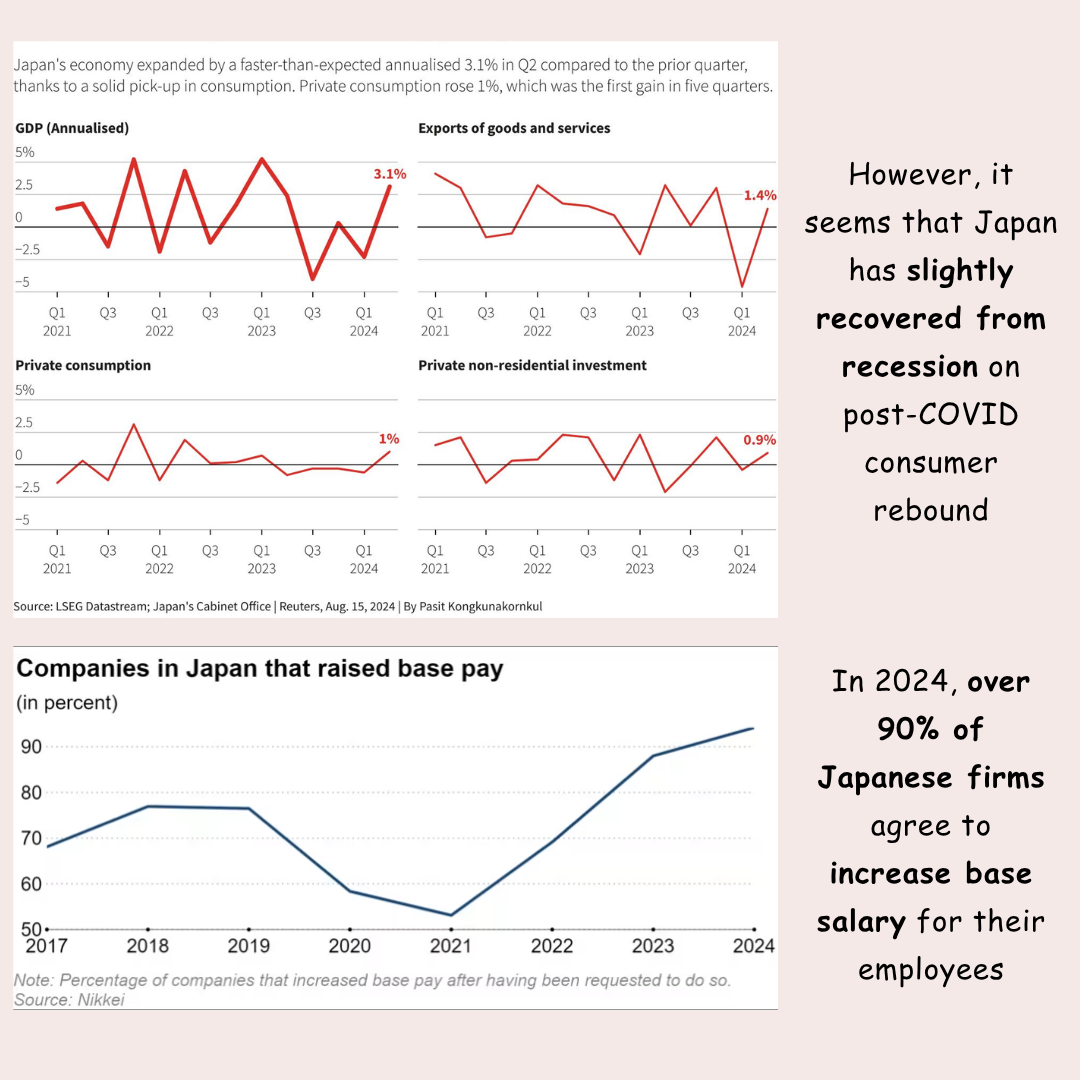

Moving forward following the COVID-19 pandemic, Japan has started to emerge from economic stagnation, which was supported by a rebound in consumer demand and rising inflationary pressures. In response, Japanese companies, both large and small, have begun to increase base salary for their employees.

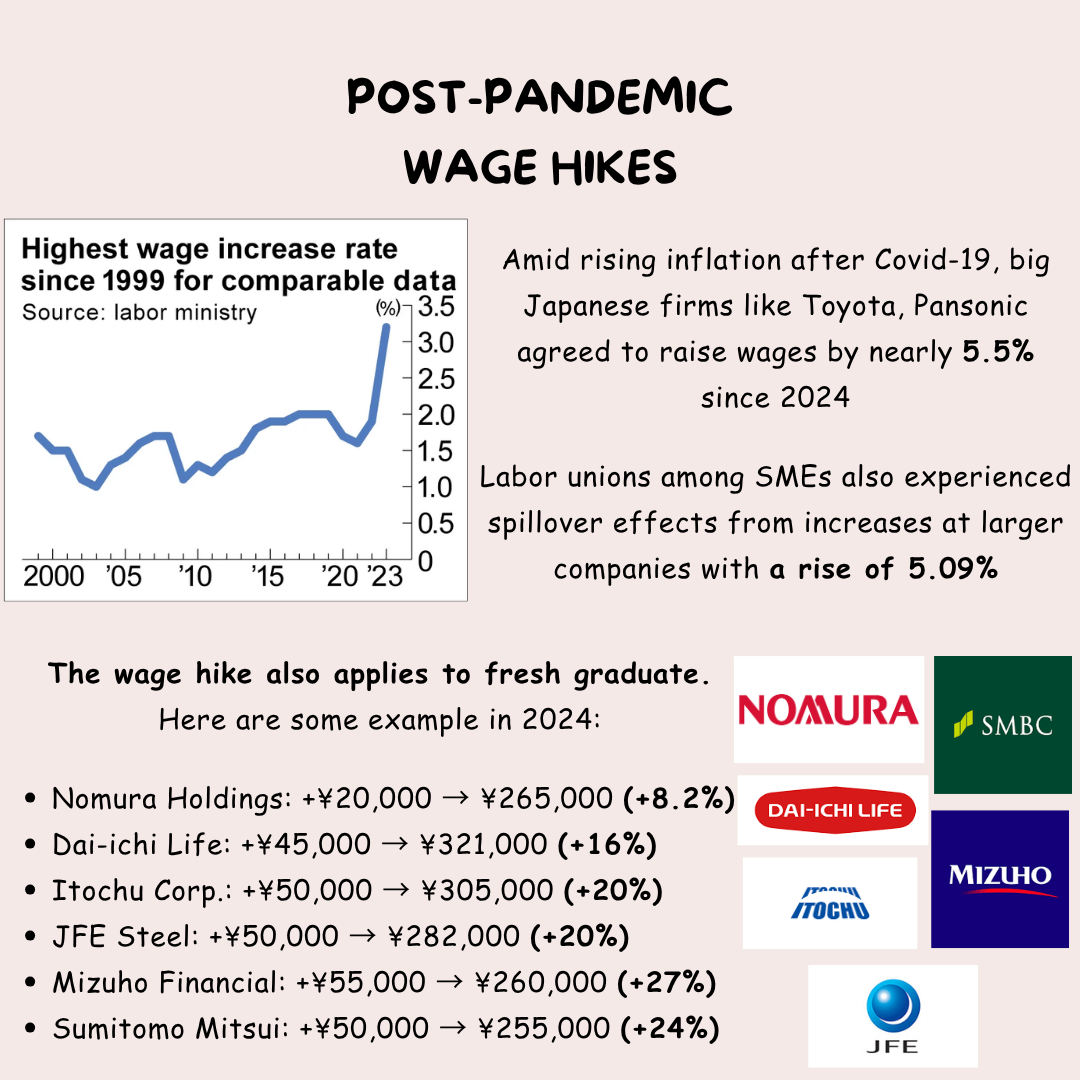

In 2024, the movement gained substantial traction with over 90% of firms agreed to increase base salaries. Leading the way were industrial giants like Toyota and Panasonic, which implemented wage hikes averaging around 5.5%. Meanwhile, SMEs also experienced spillover benefits, with labor unions successfully negotiating increases of around 5.09%.

🎓 Fresh Graduates Are Winning Big

For new entrants to the workforce, the changes are especially striking. Several major employers announced robust salary hikes for 2024, a trend that signals fresh optimism for early-career professionals:

-

Nomura Holdings: increased starting salary by ¥20,000 → ¥265,000 (+8.2%)

-

Dai-ichi Life: up by ¥45,000 → ¥321,000 (+16%)

-

Itochu Corp.: boosted pay by ¥50,000 → ¥305,000 (+20%)

-

JFE Steel: hike of ¥50,000 → ¥282,000 (+20%)

-

Mizuho Financial: rise of ¥55,000 → ¥260,000 (+27%)

-

Sumitomo Mitsui: increase of ¥50,000 → ¥255,000 (+24%)

These numbers reflect a significant rise from previous norms, where base salaries for young workers remained largely static for years.

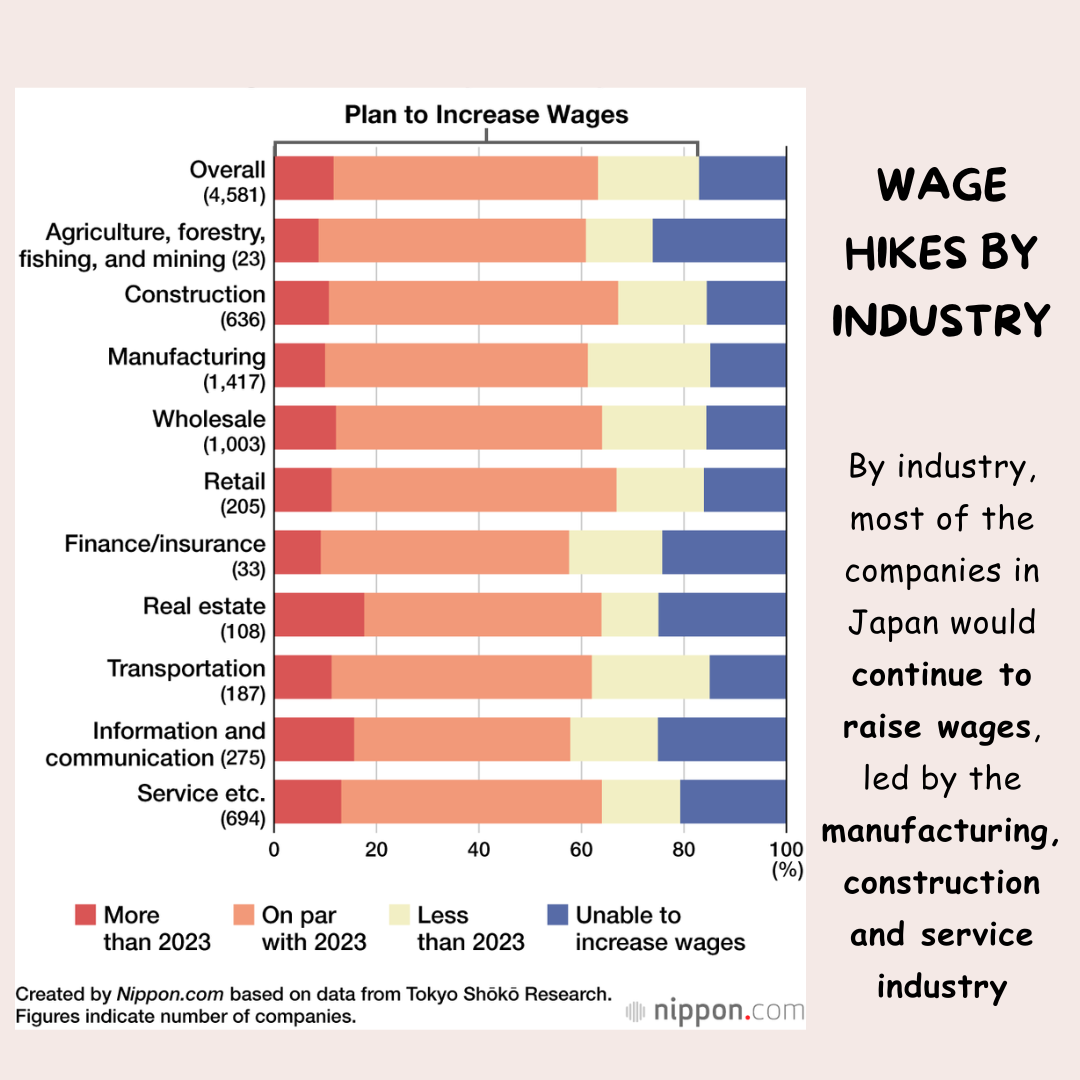

🏭 Which industry is driving the wage hikes?

A closer look at industry trends reveals that sectors such as manufacturing, construction, and services are at the forefront of these pay increases. This wave of wage growth, although might be short-term, can spark a potentially transformation for Japan’s broader economy in the near future along with the rise in AI and its technological edges in semiconductor industry.

————————————-

References:

Asia Nikkei. (2024). “Japanese companies boost wages in departure from lost decades”. https://asia.nikkei.com/Business/Business-trends/Japanese-companies-boost-wages-in-departure-from-lost-decades

The Japan Times. (2023). “Japanese banking giants bump up graduate starting salaries in talent war”. https://www.japantimes.co.jp/news/2023/03/01/business/banks-graduate-salaries/

Yomiuri Shimbun. (2024). “Japan Companies Raise Starting Salaries for New Graduates; Retention of Young Employees a Concern”. https://japannews.yomiuri.co.jp/business/companies/20240326-176737/

The Japan Institute for Labor Policy and Training (JILPT). “60 Years of “Spring Offensives”. https://www.jil.go.jp/english/researcheye/bn/RE008.html

Reuters. (2024). “Japan’s economy rebounds strongly on consumption boost, backs case for more rate hikes”. https://www.reuters.com/markets/asia/japan-q2-gdp-expands-annualised-31-april-june-2024-08-14/

Asia Nikkei. (2024). “Over 90% of Japan companies agree to base pay hikes in 2024: Survey”. https://asia.nikkei.com/Spotlight/Work/Over-90-of-Japan-companies-agree-to-base-pay-hikes-in-2024-survey

Nippon.com. (2024). “More than 80% of Japanese Companies Plan to Raise Wages in 2024”. https://www.nippon.com/en/japan-data/h01875/more-than-80-of-japanese-companies-plan-to-raise-wages-in-2024.html

Asahi Shimbun. (2024). “Survey: Wage increase rate hits the highest since 1999”. https://www.asahi.com/ajw/articles/15166586

T. Watanabe (2025). “Japan’s Chronic Deflation: Causes and Consequences”. CJEB Working Papers No. 393, Columbia University